The Best Investment Writing Volume 2

Selected Writing from Leading Investors and Authors

edited by Meb Faber

Are you looking for some ideas to help you improve your portfolio? Let the brightest, most insightful minds in investing help.

The Best Investment Writing – Volume 2 contains 41 hand-selected articles. These are the best pieces from some of the most respected money managers and investment researchers in the world.

The Best Investment Writing

Selected Writing from Leading Investors and Authors

edited by Meb Faber

Are you looking for some ideas to help you improve your portfolio? Let the brightest, most insightful minds in investing help.

The Best Investment Writing – Volume 1 contains 32 hand-selected articles. These are the best pieces from some of the most respected money managers and investment researchers in the world.

Invest With The House

Hacking The Top Hedge Funds

by Meb Faber

Picking stocks is hard—and competitive. The most talented investors in the world play this game, and if you try to compete against them, it’s like playing against the house in a casino. Luck can be your friend for a while, but eventually the house wins. But what if you could lay down your bets with the house instead of against it? In the stock market, the most successful large investors—particularly hedge fund managers—represent the house. These managers like to refer to their top investments as their “best ideas.” In this book, you will learn how to farm the best ideas of the world’s top hedge fund managers. You will learn who they are, how to track their funds and stock picks, and how to use that information to help guide your own portfolio. In essence, you will learn how to play more like the house in a casino and less like the sucker relying on dumb luck.

Global Asset Allocation

A Survey of the World’s Top Investment Strategies

by Meb Faber

With all of our focus on assets – and how much and when to allocate them – are we missing the bigger picture? Our book begins by reviewing the historical performance record of popular assets like stocks, bonds, and cash. We look at the impact inflation has on our money. We then start to examine how diversification through combining assets, in this case a simple stock and bond mix, works to mitigate the extreme drawdowns of risky asset classes. But we go beyond a limited stock/bond portfolio to consider a more global allocation that also takes into account real assets. We track 13 assets and their returns since 1973, with particular attention to a number of well-known portfolios, like Ray Dalio’s All Weather portfolio, the Endowment portfolio, Warren Buffett’s suggestion, and others. And what we find is that, with a few notable exceptions, many of the allocations have similar exposures. And yet, while we are all busy paying close attention to our portfolio’s particular allocation of assets, the greatest impact on our portfolios may be something we fail to notice altogether…

The Ivy Portfolio

How to Invest Like The Top Endowments and Avoid the Bear Markets

by Meb Faber

A do-it-yourself guide to investing like the renowned Harvard and Yale endowments. The Ivy Portfolio shows step-by-step how to track and mimic the investment strategies of the highly successful Harvard and Yale endowments. Using the endowment Policy Portfolios as a guide, the authors illustrate how an investor can develop a strategic asset allocation using an ETF-based investment approach. The Ivy Portfolio also reveals a novel method for investors to reduce their risk through a tactical asset allocation strategy to protect them from bear markets. The book will also showcase a method to follow the smart money and piggyback the top hedge funds and their stock-picking abilities. With readable, straightforward advice, The Ivy Portfolio will show investors exactly how this can be accomplished—and allow them to achieve an unparalleled level of investment success in the process. With all of the uncertainty in the markets today, The Ivy Portfolio helps the reader answer the most often asked question in investing today – “What do I do”?

Global Value

How to Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in the Stock Market

by Meb Faber

Investment bubbles and speculative manias have existed for as long as humans have been involved in markets. Is it possible for investors to identify emerging bubbles and then profit from their inflation? Likewise, can investors avoid the bursting of these bubbles, and the extreme volatility and losses found in their aftermath to survive to invest another day? Over 70 years ago, Benjamin Graham and David Dodd proposed valuing stocks with earnings smoothed across multiple years. Robert Shiller later popularized this method with his version of the cyclically adjusted price-to-earnings (CAPE) ratio in the late 1990s and correctly issued a timely warning of poor stock returns to follow in the coming years. We apply this valuation metric across more than 40 foreign markets and find it both practical and useful. Indeed, we witness even greater examples of bubbles and busts abroad than in the United States. We then create a trading system to build global stock portfolios, and find significant outperformance by selecting markets based on relative and absolute valuation.

Shareholder Yield

A Better Approach to Dividend Investing

by Meb Faber

Shareholder Yield: A Better Approach to Dividend Investing shows step-by-step how to find returns in a low yield world. Investors have flocked to dividend stocks in search of yield; however, fewer companies are paying out less in dividends due to legal, tax, and structural changes in the US markets. Dividend payments are only one use of a company’s free cash flow; other uses of cash include: share repurchases, debt paydown, reinvestment in the business, and mergers and acquisitions. Consequently, investors in the 21st century must look to all of the direct and indirect ways in which companies distribute their cash to shareholders, a metric commonly referred to as “Shareholder Yield”. In this book, we analyze portfolios based on the various cash flow metrics and find that portfolios of companies with high shareholder yields outperform both broad market indices and high dividend yield portfolios by a substantial margin. With all of the uncertainty in the markets today, Shareholder Yield helps the reader answer one of the most often asked question in investing today – “Where do I find yield”?

Meb Faber’s White Papers

Can We All Invest Like Yale?

David Swensen is regarded as one of the greatest capital allocators of all time, if not the greatest. Before his passing in 2021, Swensen’s tenure at the Yale University endowment office was legendary. The endowment returned over 13% per annum, higher than any relevant benchmark, including the unstoppable US stock market, and with lower volatility, too. Does Yale have the magical formula, or is it possible for the public market investor to achieve anything near Swensen’s returns? Can any of us really invest like Yale?

Do You Pay Taxes? Then Avoid Dividends and Do this Instead

In this white paper, we question an investing strategy that’s so beloved, it borders on sacrosanct – dividend-investing. Yet if you love dividends, we encourage you to keep an open mind, for rejecting these ideas would only shortchange yourself. That’s because we believe the alternative approach we suggest you consider has the potential to increase your returns significantly. And that’s just the start, because we think it also carries benefits that could result in even greater improvements for taxable investors.

Introduction to the 351 ETF Exchange

Over the past few decades, investors have come to appreciate the ETF structure for numerous reasons—intraday liquidity, low fees, and tax efficiency. These features have led to investors voting with their dollars, and flows have been consistent from traditional high-fee, tax-inefficient vehicles into the ETF structure.

To borrow and alter a quote from Marc Andreessen, we believe that “ETFs are eating the asset management industry (in a good way!).”

However, while investors appreciate the ETF’s inherent tax efficiency, they often hold legacy stock positions with big capital gains. Selling their holdings and transitioning to an ETF would require a hefty tax bill.

Is it possible to transition their low-basis investments into the ETF structure tax-efficiently?

Section 351 ETF Conversion FAQs

Common questions and answers related to Section 351 ETF Conversions.

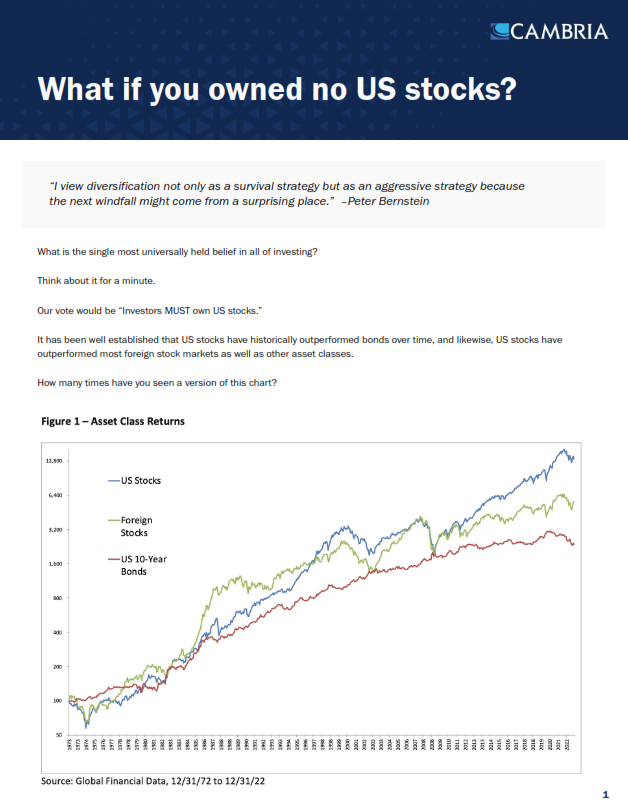

What if You Owned No US Stocks?

What is the single most universally held belief in all of investing?

Think about it for a minute.

Our vote would be “Investors MUST own US stocks.”

We believe there are many paths to building wealth. Relying on a concentrated bet in just one asset class in just one country can be extremely risky. While we often hear investors describe their investment in US market cap indexes as “boring,” historically, that experience has been anything but.

The Bear Market in Diversification

First, a warning.

If you’re an investor or, even worse, a financial advisor with a globally diversified portfolio, you may want to stop reading now. Continuing may just be too painful. Raise your hand if you muttered any of the following phrases to yourself. For the financial advisors out there, this list is probably just the beginning…

“Can you explain why we own foreign stocks? All they do is underperform. China is down 60%!”

“Why do we hold Gold? Ok, Boomer…”

“Everyone knew investing in bonds at 1% was a dumb idea, why didn’t you?”

“I read recently that GDP was going to accelerate to 50% a year due to AI. Can we sell all these underperforming

value funds and buy QQQ and NVDA?”

“This portfolio is much more volatile than my neighbor’s – he’s in private equity and real estate, and it moves

WAY less…”

I could go on, but it would just be cruel. You know all this because you lived through “The Bear Market in Diversification”.

T-Bills and Chill…Most of the Time

For the first time in a long time, fixed income investors have yield.

As of this writing in February 2024, short-term Treasuries yield over 5%, and long-term Treasuries around 4%.

Gone are the days of 0%, or even negative yielding bonds. (How weird was that?)

Retirees and fixed income investors are rejoicing, many acting like they just won the retirement lottery. For now, we’ll ignore the bond declines of 10%, 20%, or even 50% to get here.

Thus, the most popular financial phrase of 2023: let’s just “T-bills and Chill”.

Now that investors have reawakened to fixed income as an asset class; it opens the doors to all types of other bonds. Outside of US government bonds there are corporate bonds, junk bonds, mortgage backed bonds, TIPS, foreign bonds, and even Bowie Bonds.

How is an investor supposed to go about choosing between all of the various choices available?

A Better Approach to Dividend Investing

Many investors are drawn to dividend paying investments, and it’s easy to see why. Investors fantasize about sitting in a beach chair, pina colada in hand, while passive income rolls into the bank account.

There are limitless strategy permutations for how to invest in dividend paying stocks. The two main flavors tend to be “dividend income” and “dividend growth”.

In their recent report, “Searching for Great Dividend Funds” Morningstar calculates that there are 348 open-end mutual funds and ETFs with over $1 trillion dollars focused on dividends. At a hypothetical 3% dividend yield, that $30 billion in cash dividend buys a lot of pina coladas.

Continuing on in their research article, Morningstar sets out to find some “Great Dividend Funds”.

However, there’s a big problem. We believe they’re looking in the wrong place.

Over a decade ago our CEO Meb Faber tackled this exact topic in his book Shareholder Yield: A Better Approach to Dividend

Investing.

The basic thesis was that due to a structural shift in markets, companies altered how they distributed their cash to investors. While a majority of companies used to return cash to shareholders predominantly via cash dividends, starting in the 1990s companies shifted to only distributing a minority of their cash through dividends. What took their place?

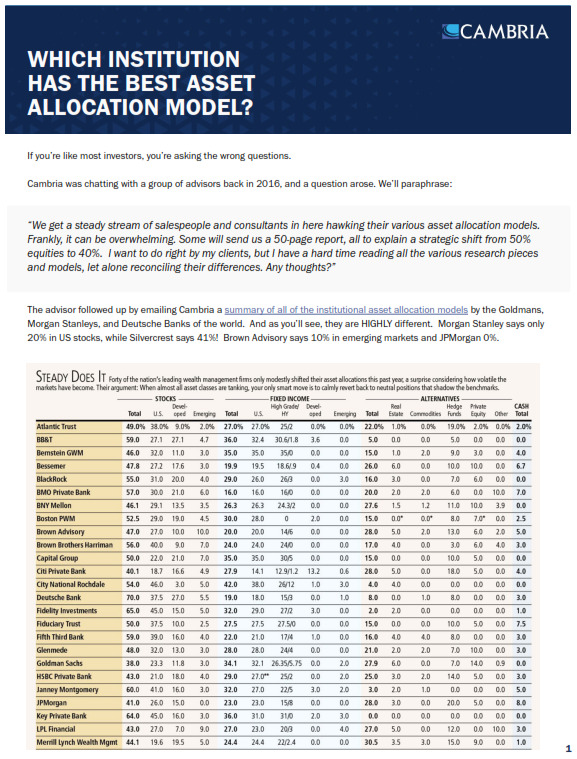

Which Institution Has the Best Asset Allocation Model?

If you’re like most investors, you’re asking the wrong questions.

Cambria was chatting with a group of advisors back in 2016, and a question arose. We’ll paraphrase:

“We get a steady stream of salespeople and consultants in here hawking their various asset allocation models.

Frankly, it can be overwhelming. Some will send us a 50-page report, all to explain a strategic shift from 50%

equities to 40%. I want to do right by my clients, but I have a hard time reading all the various research pieces

and models, let alone reconciling their differences. Any thoughts?”

The advisor followed up by emailing Cambria a summary of all of the institutional asset allocation models by the Goldmans,

Morgan Stanleys, and Deutsche Banks of the world. And as you’ll see, they are HIGHLY different. Morgan Stanley says only

20% in US stocks, while Silvercrest says 41%! Brown Advisory says 10% in emerging markets and JPMorgan 0%.

Meb’s Best – Ranked

Our CIO, Meb Faber has been publishing papers, books and blog posts for over 15 years covering everything from asset

allocation strategies and global value investing, to farmland investing, to startups, and even the question of whether or

not institutions and endowments should just be managed by a robot. With thousands of pieces of content, we thought

it was time to sift through them all and try to rank the best! So here we go, starting with a countdown from 30….what

will be the winner at #1?

What is the Safest Investment Asset?

Let’s say you’ve “won the game.”

“Funded contentment”. That’s the description my friend Brian Portnoy uses to describe the purpose of wealth accumulation.

Essentially, enough money to live the life you’ve dreamed about.

Now, what that amount is varies for all of us. For some it could be $100,000, for others $1 million or even $10 million

wouldn’t be enough. But let’s say you hit your number.

What now? What if we no longer care about increasing our wealth, but rather, to simply protect it. As mentioned before, the

portfolio that helps you get rich isn’t necessarily the portfolio that’s going to help you remain rich.

So what is the “safest” asset in the world? Is there such a thing?

All Time Highs A Good Time to Invest? No. A Great Time.

Many investors fear buying at recent or all-time highs.

This is understandable. It can feel like you’re chasing performance or showing up at the party just a few minutes before the hosts kick everyone out.

But if we go strictly by the numbers, they paint a different picture. Buying at highs is often aligning your capital with strength, rather than exposing it to weakness.

You’re following a trend. In this case, the trend of climbing stock prices. (And the alternative is equally as important – you’re NOT following the downtrend of falling stock prices.)

Trend following doesn’t just offer strong returns. No matter how you measure it, regardless of the specific parameters of your preferred model, trend can potentially help reduce volatility and drawdowns.

Think Income and Growth Don’t Exist Around the Globe? Think Again.

In early 2017, we wrote a paper called “Think Income and Growth Don’t Exist in This Market? Think Again” that sought to address a question facing many U.S. equity investors…

Was it possible to find a U.S. equity investment that offered an attractive yield, yet came without a lofty, dangerous valuation?

Our paper concluded that we believed there was an answer.

And so, investors considering income investments in the global opportunity set find themselves facing a similar predicament. Is there a balance between income and growth? We penned a foreign companion to our original US paper, and in this updated version, we still believe the answer is “yes” – in fact, this time, you have two potential options.

Think Income and Growth Don’t Exist in This Market? Think Again.

Are you having the following argument with yourself?

“I need an investment that’s going to provide me not only potential income, but potential growth too. Unfortunately, investors piled into dividend funds for years in their search for yield, meanwhile, equity valuations have been driven higher. I’m worried this has left me few reasonably-valued opportunities. If I invest in a potentially overvalued dividend fund today and this bull market finally runs out of steam tomorrow, then I’m risking serious losses. On the other hand, keeping my money on the sidelines offers some yield, but I might miss out on growth opportunities. Is there an answer?”

As we’re about to show you, yes, we believe there is an answer – and one we feel is a good one. Income and growth are still possible, even in this market, though admittedly, harder to find.

The Investment Pyramid

If you’re over the age of 30, you probably remember the USDA’s Food Pyramid. It represented the best thinking (at that time) as to how Americans should structure their diets for optimum health. Unfortunately, its suggestion of a foundation of carbohydrates no longer seems as prudent as once it did. Similar to the Food Pyramid, the best investment thinking of 50 years ago seems a bit silly and outdated to us now, given the layers of knowledge that have accumulated in the years since. In this white paper, we look at the Investment Pyramid of yesterday, and suggest what we believe is an effective one for today.

Worried About the Market? It Might Be Time for this Strategy

As we get closer to the end of this bull market, whenever that may be, we see many investors are wondering two things: 1) will “whatever’s next” be as bad as 2000 and 2008; and 2) if so, is there a way to avoid it?

No one knows exactly when this bull will finally run out of steam, or how far it will fall; yet, there are signs we’re approaching an inflection point.

In this white paper, we’ll cover four signs of an aging bull, briefly revisit traditional strategies to help protect your portfolio, then highlight a strategy that has the potential to actually profit during a bear market. In our Appendices, we’ll wrap up by detailing an extension to this strategy that many investors might find interesting, and we’ll offer a pointed word to advisors.

The Trinity Portfolio

Does market uncertainty have you concerned about your wealth? If so, you’re not alone.

Many investors today are anxious because they lack a cohesive plan. Their investments are more an assortment of unrelated assets than deliberately-chosen pieces of a unified strategy. Unfortunately, this can leave their wealth exposed.

Our Trinity Portfolio offers a different approach. It’s a holistic investing framework, sturdy, as it’s rooted in respected, wealth-building investment principles, yet also strategic, able to adapt to all sorts of market conditions. The result is a unified framework that we believe can help relieve investors of the anxiety of “what’s the right strategy right now?”

Do you want help generating real investing wealth with less anxiety? Read how the Trinity Portfolio can help.

A Quantitative Approach to Tactical Asset Allocation

In this paper we update our 2006 white paper “A Quantitative Approach to Tactical Asset Allocation” with new data from the 2008-2012 period. How well did the purpose of the original paper – to present a simple quantitative method that improves the risk-adjusted returns across various asset classes – hold up since publication? Overall, we find that the models have performed well in real-time, achieving equity like returns with bond like volatility and drawdowns. We also examine the effects of departures from the original system including adding more asset classes, introducing various portfolio allocations, and implementing alternative cash management strategies.

Relative Strength Strategies for Investing

The purpose of this paper is to present simple quantitative methods that improve risk-adjusted returns for investing in US equity sectors and global asset class portfolios. A relative strength model is tested on the French-Fama US equity sector data back to the 1920s that results in increased absolute returns with equity-like risk. The relative strength portfolios outperform the buy and hold benchmark in approximately 70% of all years and returns are persistent across time. The addition of a trend-following parameter to dynamically hedge the portfolio decreases both volatility and drawdown. The relative strength model is then tested across a portfolio of global asset classes with supporting results.

Global Value: Building Trading Models with the 10 Year CAPE

Over seventy years ago Benjamin Graham and David Dodd proposed valuing securities with earnings smoothed across multiple years. Robert Shiller popularized this method with his version of this cyclically adjusted price-to-earnings ratio (CAPE) in the late 1990s, and issued a timely warning of poor stock returns to follow in the coming years. We apply this valuation metric across over thirty foreign markets and find it both practical and useful, and indeed witness even greater examples of bubbles and busts abroad than in the United States. We then create a trading system to build global stock portfolios based on valuation, and find significant outperformance by selecting markets based on relative and absolute valuation.

Where the Black Swans Hide & the 10 Best Days Myth

Below we examine market outliers in financial markets. How much effect do these outliers have on long term performance? Can the investor prepare for these anomalies, or are they truly ‘black swans’ that cannot be managed? In this issue we examine numerous global financial markets on daily and monthly time frames. We find that these rare outliers have a massive impact on returns. However, these outliers tend to cluster and the majority of both good and bad outliers occur once markets have already been declining. We critique the “missing the 10-best-days” argument proffered by advocates of buy and hold investing, demonstrating that a significant majority of the 10 best days and the 10 worst days occur in declining markets. We continue to advocate that investors attempt to avoid declining markets where most of the volatility lies, and conclude that market timing and risk management is indeed possible, and beneficial to the investor.

Learning to Love Investment Bubbles: What if Sir Isaac Newton had been a Trendfollower?

Investment manias and financial bubbles have likely existed for as long as humans have been involved in financial markets. In this research piece we take a look at some of the more famous market bubbles in history and the extreme volatility and drawdowns they experienced. We then examine a simple trendfollowing approach investors could use to manage their risk. Across twelve market bubbles we find that a trendfollowing system would have improved return while reducing volatility. Most importantly, it would have reduced drawdowns significantly leading to the most important rule in all of investing – surviving to invest another day.

Finding Yield in a 2% World

Many investors are surprised to learn that the largest asset class in the world is foreign debt. US investors often allocate very little to foreign bonds, and when they do, it is through capitalization weighted indexes. These indexes allocate the highest weighting to countries with the most debt outstanding. Is there a better way to invest in global bonds? We examine a simple value approach applied to global sovereign bonds and find that it works well across decades. In a world of very low and even negative yields, a value approach could potentially add a well needed source of income to a diversified portfolio.

Learning to Play Offense and Defense: Combining Value and Momentum from the Bottom Up, and the Top Down

Sorting stocks based on value and momentum factors historically has led to outperformance over the broad US stock market. However, any long-only strategy is subject to similar volatility and drawdowns as the S&P 500. Drawdowns of 50%, or even 60-90% make implementation of a stock strategy very challenging. Is there a way to add value on stock selection, but also reduce volatility and drawdowns of a long only strategy with hedging techniques? In this paper we examine the possibility of following a strategy that combines aggressive offense and smart defense to target outsized returns with manageable risk and drawdowns.

What if 8% is Really 0%? Pension Funds Investing with Fingers-Crossed and Eyes Closed

It is well known that pension funds in the United States are underfunded even if they achieve their projected 8% rate of return. The scope of pension underfunding increases to an astonishing level when more probable future rates are employed. A reduction in the future rate of return from 8% to the more reasonable risk-free rate of approximately 4% causes the liabilities to explode by trillions of dollars. As bond yields declined over the past twenty years, pension funds moved toward more aggressive equity-based portfolios in an attempt to reach for this 8% return. By investing in a portfolio with uncertain outcomes, pension funds could experience increasingly volatile and even negative returns. Paradoxically, in an effort to chase the universal 8% rate, pension funds may be laying the groundwork for returns even lower than the risk free rate. In an effort to offer an empirical basis for this possibility, we conclude the paper with a relevant comparison – the return of a hypothetical Japanese pension for the past two decades. We believe that pension funds need to at least prepare for the unfathomable: 0% returns for 20 years. Most pension funds, regrettably, have not adequately stress tested their portfolios for these scenarios.

Global CAPE Model Optimization

We use the Shiller CAPE Model proposed by Mebane Faber as a template for the exploration of a variety of portfolio optimization methods. By virtue of the Model’s systematic allocation to the ‘cheapest’ markets with the highest theoretical risk premia, the model has the potential to extract high costs from ‘behavioural taxes’ related to the model’s extreme volatility and drawdown character. We apply several portfolio optimization techniques with the objective of maximizing portfolio Sharpe ratios and minimizing drawdowns, including dynamic volatility weighting, risk parity, target risk and minimum variance. Consistent with recent published research on robust portfolio optimization, return to risk ratios improve broadly, with the greatest impact achieved from procedures that manage positions and/or portfolios to an ex ante target volatility. A theoretical framework is also proposed.

Politics and Profit: Combining the Presidential Cycle and the January Effect

Does the intersection of two market anomalies set the stage for outsized performance? The first is what is known as the Presidential Cycle. This theory goes that equity returns during the third and fourth years of a President’s term are more favorable than the first two years. A second market bias is the large outperformance of small cap stocks in January. Historically small caps outperformed large caps in 80% of all Januaries by 3 percentage points per year. Historically across the 48 months in the four year cycle the January of Year 3 is the single biggest outperformer with median returns since 1927 of nearly 8% a month for small caps. Does this mean that January is guaranteed to be great? Again, nothing is guaranteed – Year 3 Januaries have varied from 27% to down 10%. While many of these tendencies are just that, investors can view them as head or tailwinds that could give bulls and bears pause.

The Meb Faber Show Podcast

Ready to grow your wealth through smarter investing decisions?

With The Meb Faber Show, you’ll hear Meb discuss the craft of investing, helping listeners uncover new and profitable ideas in the global equity, bond, and real asset markets.

You can also expect to hear from some of the top investment professionals in the world as guests.

So join Meb each week for real market wisdom that can help make you wealthier and wiser. Better investing starts here.

You can listen to The Meb Faber Show through:

Disclaimer: All opinions expressed by website participants are solely their current opinions and do not reflect the opinion of Cambria Investments, Inc. (“Cambria”) or affiliates. The website participants opinions are based upon information they consider reliable but neither Cambria or its affiliates warrant its completeness of accuracy, and it should not be relied on as such.

Past performance is not indicative of future results. Strategies or investments discussed may fluctuate in price or value. Investment or strategies mentioned in this website may not be suitable for you and you should make your own independent decision regarding them. This material does not take into account your particular investment objectives, financial situation or needs and is not intended as recommendations appropriate for you.

Want investing updates sent straight to your inbox?

Investing Articles from Meb Faber

Unshakeable by Tony Robbins: The Right Diagnosis, the Wrong Prescription?

A few readers asked if I would take a look at Tony Robbin’s new book Unshakeable and offer up my thoughts. (We reviewed his last book Money a few years back here.) Most of my [...]

Cash Cows of the Dow

Long time readers know that I have been a shareholder yield advocate on the blog for almost a decade. (We used to call it net payout yield back then, and we define it as the [...]

Dividend Stocks Are the Worst

We’ve written three fun articles on the topic of dividends in the past few years. I’m not sure why we haven’t seen more research here in the academic space, perhaps it is the hundreds of billions [...]